franklin county ohio sales tax on cars

The Ohio state sales tax rate is currently. The county sales tax rate is.

Pennsylvania Sales Tax Rate Rates Calculator Avalara

If the leasing company sells the vehicle to a dealer it is no longer available to be used as a trade-in by the lessee.

. Sales tax is required to be paid when you purchase a motor vehicle or watercraft. The minimum combined 2022 sales tax rate for Franklin Ohio is. As an example if you pay 20000 for a car in a private sale then the sales tax would be 1150.

What is the sales tax on cars in Franklin County Ohio. The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance to which you may be entitled. The Franklin County sales tax rate is.

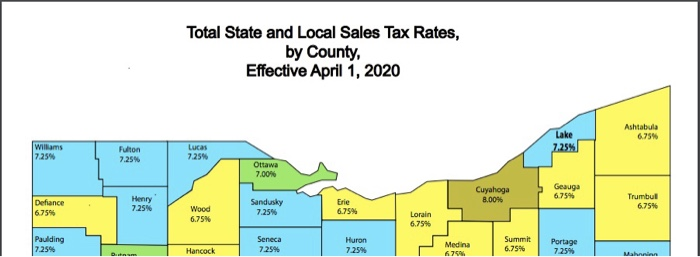

Franklin County Ohio Sales Tax On Cars As of January 1 2020 the sales tax rate for Franklin County Ohio is 725. In addition to franklin county a 05 percent sales tax funding. According to the Sales Tax Handbook you pay a minimum of 575 percent sales tax rate if you buy a car in the state of Ohio.

Franklin County OH Sales Tax Rate The current total local sales tax rate in Franklin County OH is 7500. You may obtain county sales tax rates through the Ohio Department of Taxation. The 2018 United States Supreme Court decision in South Dakota v.

How much will my taxes be. We accept cash check or credit card payments with a 3 fee. You need to pay taxes to the county after you.

A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax. Franklin Countys is 75. There are also county taxes that can be as high as 2.

1500 title fee plus sales tax on purchase price add 100 fee per notarization andor 150 for out-of- state transfers. Some cities and local. Ohio collects a 575 state sales tax rate on the purchase of all vehicles.

Ad Lookup OH Sales Tax Rates By Zip. Free Unlimited Searches Try Now. This rate is made up of a 675 state sales tax rate.

The Ohio sales tax rate is currently. You may obtain county. This is the total of state county and city sales tax rates.

Listing of upcoming properties for sale. This table shows the total sales tax rates for all cities and. The answer would be yes if the lessee purchased the leased vehicle.

The Franklin County Sales Tax is 125. The December 2020 total local sales tax rate was also 7500. Some dealerships may also charge a 199 dollar documentary.

You will have to pay the 575 sales tax on private car sales to the Ohio DMV. The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales. Your tax rate depends on your county of residence.

Ohio collects a 575 state sales tax rate on the purchase of all vehicles.

Oregon Resident Killed In Crash On Highway 126w Local Kezi Com

Ohio Sales Tax Holiday When It Is And What To Know

Equitable Electric Vehicle Parking

Car Sales Tax In Ohio Getjerry Com

Ohio Taxes Apps On Google Play

Used Cars For Sale In Columbus Oh Cars Com

2018 Ohio Demolition Derbies News And Events Volunteers Of America

Ohio Form 2290 Heavy Highway Vehicle Use Tax Return

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

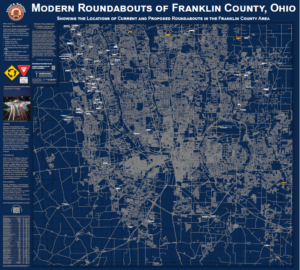

Maps Franklin County Engineer S Office

Ohio Tax Free Weekend 2022 Set For Aug 5 7 With Back To School Sales

Car Sales Tax In Ohio Getjerry Com

New Ohio Jail On Track To Open In 2021 Correctional News

Ohio Vehicle Sales Tax Fees Calculator Find The Best Car Price

Franklin Township Police Department

Franklin Township Police Department Lacks Funds To Staff Overnight Officers Wsyx

Lo 23 2 Research 31 Cuyahoga County Ohio Has A Chegg Com

Franklin County Auditor S Office Fc Auditor Twitter

New Ohio Law Eliminating Front License Plate Takes Effect Wkbn Com