pay mississippi state taxes by phone

Mississippis income tax ranges between 3 and 5. An instructional video is available on TAP.

Mississippi property tax laws have special rules for senior citizens who are older than 65 and people who are disabled regardless of age.

. If you cannot check online you may call 601 923-7801. Mississippi State sales tax. The Mississippi Income Tax Estimator Lets You Calculate Your State Taxes For the Tax Year.

General Information phone 601 923-7700 Tax Refund Information. Funded by the US. For information on your tax refund 24 hour refund assistance is available touchtone phones only.

Taxpayers must pay personal income tax to the federal government 43 states and many local. The state of Mississippi does have a business income tax. Pay by credit card or.

If someone makes less than 5000 they pay a minimum. Instead of the 300 credit the first. Mississippi corporate tax is calculated on a marginal scale whose range is from 30 to 50 for 2020.

You will need your. His annual taxable income is 23000. You can make electronic payments for all tax types in TAP even if you file a paper return.

Mississippi State Income Tax Forms for Tax Year 2021 Jan. Lets take a look at an example provided by the Mississippi Department of Revenue. Those needing TTY assistance may call 800-582-2233.

1-601-923-7801 24 hours refund line Hours. SBAgovs Business Licenses and Permits Search Tool. You will be taxed 3 on any earnings between 3000 and 5000 4 on the next.

Mississippi Department of Finance and Administration. Cre dit Card or E-Check Payments. The state uses a simple formula to determine how much someone owes.

Taxpayer Access Point TAP. Department of Labor through the Mississippi Department of Employment Security. The Federal or IRS Taxes Are Listed.

This is only a high level federal tax income estimate. The Mississippi Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. Pay mississippi state taxes by phone Friday April 15 2022 Edit.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. 313 rows TOTAL TRANSACTION TAX. The Federal or IRS Taxes Are Listed.

Pay mississippi state taxes by phone. John is filing as a single taxpayer in Mississippi. Details on how to only.

105 per month per line total transaction tax. General Information phone 601 923-7700 Tax Refund Information. Access interstate and intrastate Wireless 911 911 training fee.

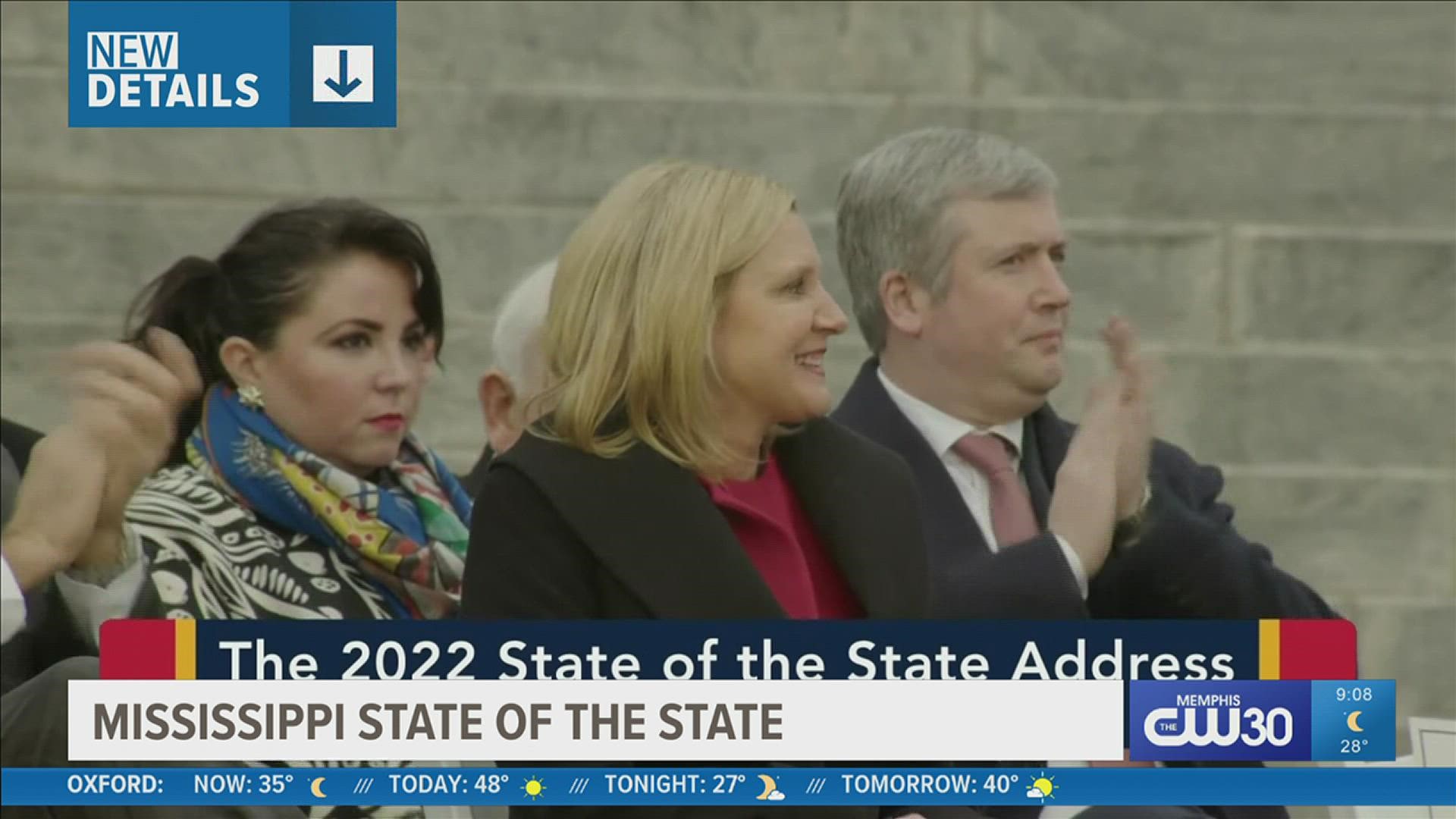

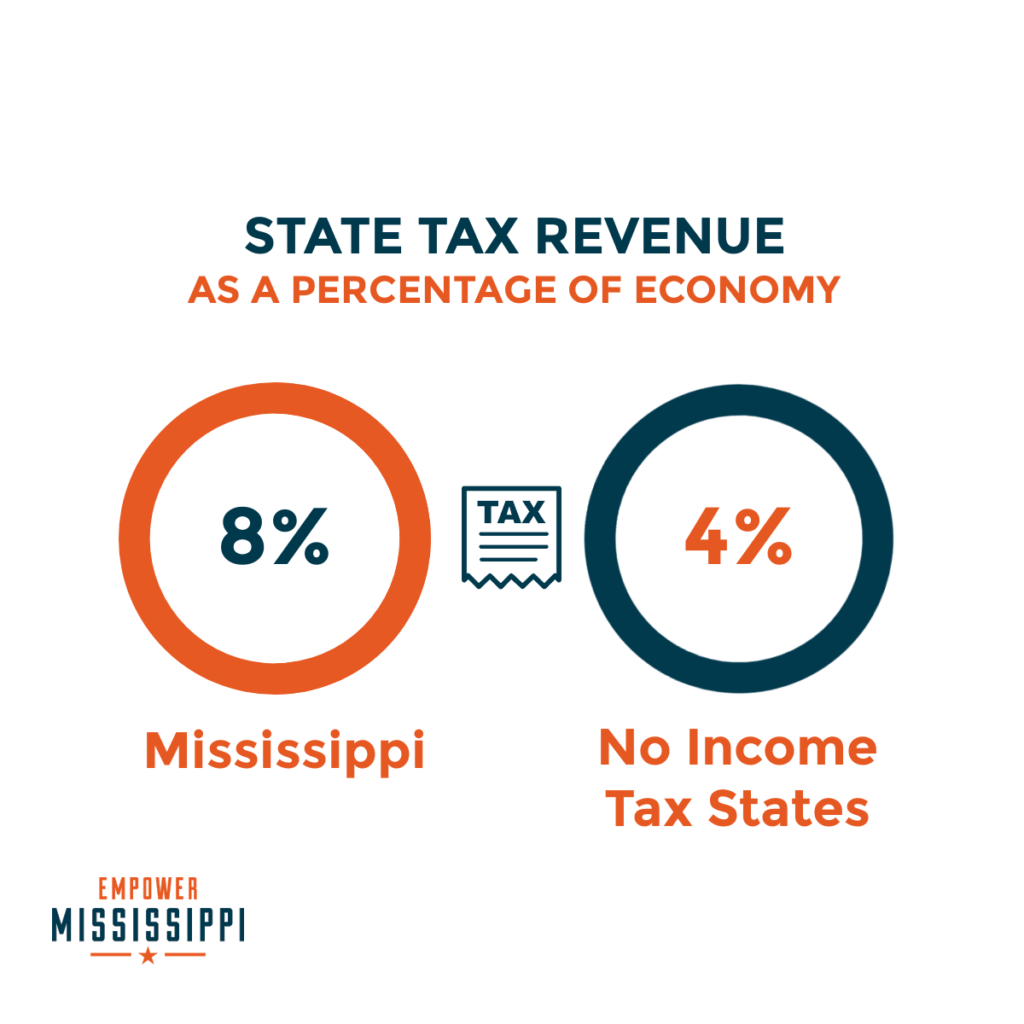

But How Will We Fund Government Without Income Taxes

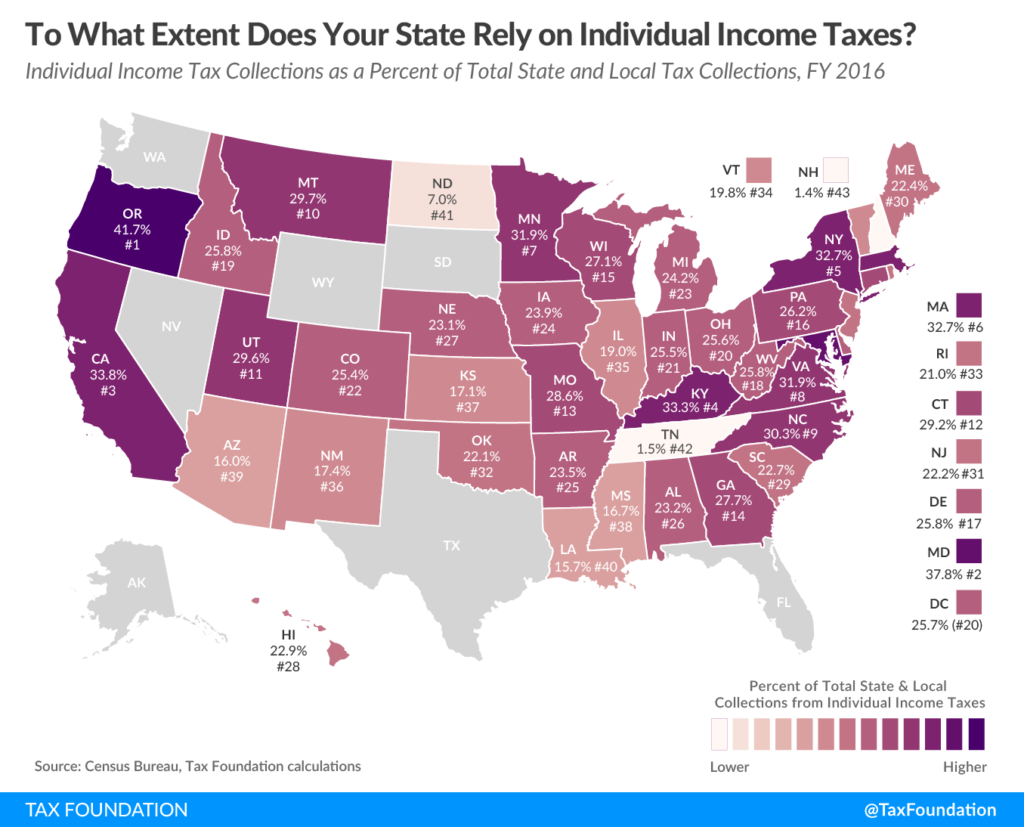

How Do State And Local Sales Taxes Work Tax Policy Center

Politicians Have Been Slashing Taxes But Poll Indicates Mississippians Willing To Pay Higher Taxes Mississippi Today

Philip Gunn S Plan To Cut Mississippi Income Taxes Ready For Vote

Military Retirement And State Income Tax Military Com

Reeves Signs Historic Tax Reform

State Individual Income Tax Rates And Brackets Tax Foundation

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi County Property Tax A Secure Online Service Of Arkansas Gov

Mississippi Department Of Revenue Issues Updated Covid 19 Guidance Extended Deadlines Telework Nexus Forbearance Cooking With Salt

Mississippi Sales Tax Calculator And Local Rates 2021 Wise

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Sales Taxes In The United States Wikipedia

Mississippi State Tax Software Preparation And E File On Freetaxusa

Harrison Legislators Could Force Local Officials To Raise Property Taxes As They Slash State Taxes By Record Amount The Sun Sentinel

Mississippi Governor Raise Teacher Pay Cut Taxes Localmemphis Com

But How Will We Fund Government Without Income Taxes

A Look At Mississippi S Reliance On Individual Income Taxes Mississippi Center For Public Policy